Copper market will change is becoming a consensus around the world. We poised the global copper market for a period of significant upheaval, driven by a powerful clash between soaring demand and strained supply. This essential industrial metal, often called “Dr. Copper” for its ability to diagnose the health of the global economy, is at the heart of the energy transition, positioning it for a fundamental shift.

On the demand side, the push for decarbonization is creating an unprecedented surge. Electric vehicles (EVs), which use up to four times more copper than conventional cars. And along with renewable energy systems like wind and solar farms, which are heavily copper-intensive, are becoming major demand drivers. This green energy revolution is layering onto the consistent demand from traditional sectors. Such as construction and infrastructure development in emerging economies.

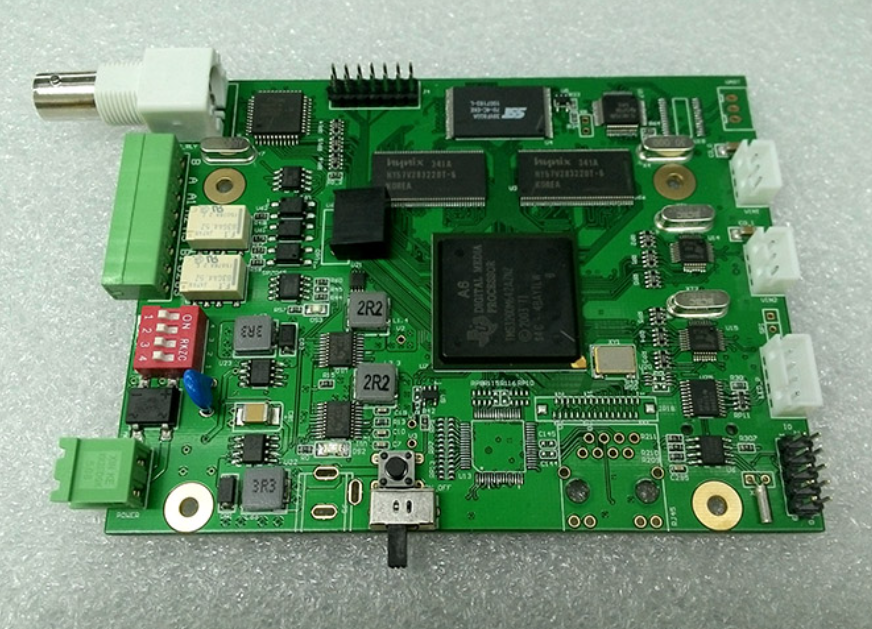

Battery grade copper market prices unchanged and still so high, the price of 8um product in 86-87 yuan / kg. Affected by the uncertainty of new energy vehicles subsidy policy, power battery production enterprises of cut their production gradually increased since November. This phenomenon leading to copper procurement slowed and the prices rosepotential of battery gradecopper convergence. On the other hand, the circuit board copper copperis still scarce, the price is keeping at a high level. And the profit is significantly higher than that of battery grade copper. At present, many manufacturers shift the copper foil production capacity to the PCB copper foil production in order to obtain short-term profits.

However, the supply side is struggling to keep pace. The pipeline for new large-scale mine projects is limit. With declining ore grades at existing mines and significant capital investment hurdles. Furthermore, geopolitical tensions in key copper-producing regions. And increasing environmental and social governance (ESG) pressures add layers of complexity and risk to supply stability.

This imbalance between robust demand and constrained supply suggests a high probability of sustained structural deficits in the coming years. The consequence will likely be continued price volatility and higher average prices. To adapt, the market will see an increased focus on recycling to supplement primary supply, greater investment in mining innovation. And potential strategic stockpiling by nations. In essence, the copper market is evolving from a cyclical commodity into a strategic asset critical to our electrified future.