PCB industry development China: The core base of PCB industry of the world

PCB industry development, China as the biggest PCB manufacturer country of the world, account for more than 50% of the global market share, with complete industry chain and strong techlonogy capability.

Industrial scale is huge, in 2023, the output value of PCB china exceeded 40 billion us dollar, accounting for half total output of the world.

Technological advantage is very obvious.

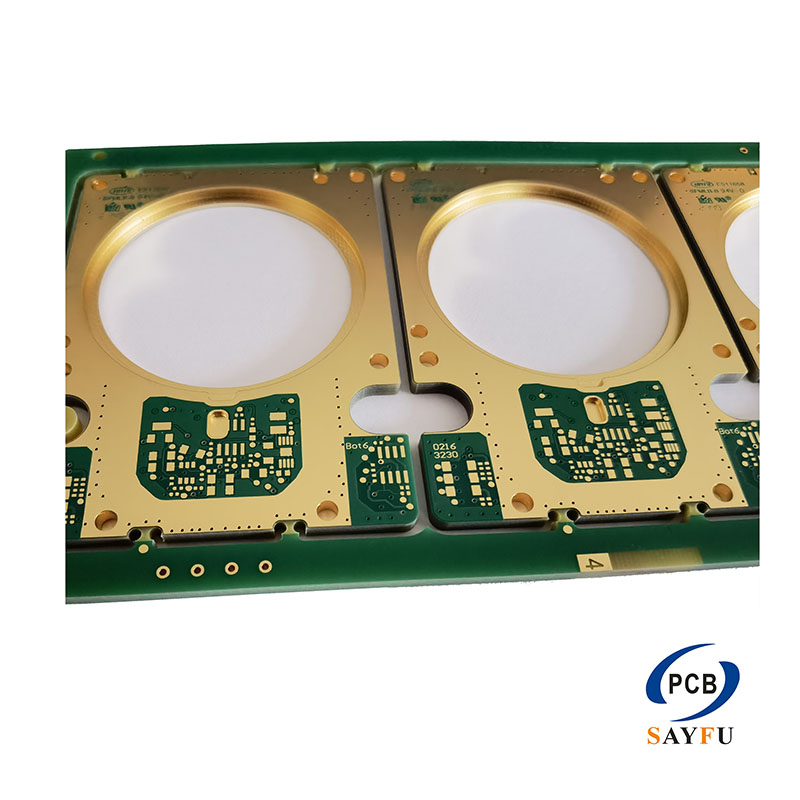

At the top level globally in high-end fields such as high-density interconnection boards (HDI), flexible circuit boards (FPCB), and IC carrier boards.

The cluster effect is prominent.

The supporting supply chain is mature and complete, capable of meeting the entire production process requirements from raw materials to finished products.

However, in recent years, PCB in china is facing the dual stress from labor cost increase continuously and enviroment protect supervisor strictly.

Take Shenzhen as a example, tech worker’s average salary increase by 40% in the past 5 years, a part enterprises begain to move low lever capability to southeast Asia

Southeast Asia: The rapidly emerging new force in the PCB industry

The Southeast Asian countries, with their significant cost advantages and favorable investment promotion policies, are becoming important destinations for the global PCB industry’s relocation.

Vietnam has performed the most outstandingly. In 2023, its PCB export volume increased by 25%, attracting multinational enterprises such as Samsung and Canon to set up production bases. These bases mainly handle consumer electronics-related PCB orders.

With its well-established automotive industry chain, Thailand has a unique advantage in the field of automotive electronic PCBs, with related products accounting for over 35% of its total PCB output. Malaysia, on the other hand, has established a position in the high-end packaging substrate sector thanks to its developed semiconductor industry.

However, the Southeast Asian region still faces constraints due to incomplete industrial chain integration.

China sell Approximately 60% of key raw materials , and there is a shortage of technical talent, making it difficult to undertake high-end PCB manufacturing in the short term.

Future outlook: global PCB industry will present a situation where gradient transfer and coordinated development coexist. China will continue dominant position in the high-end PCB sector, meanwhile maintaining competitiveness through intelligent manufacturing upgrades and technological innovation.

Overall, although the trends of industry transfer is abvious, but China with its complete industrial ecosystem and continue technological invonation, will be the re main the dispensable core of the global. It’s predicted that in 2025, China’s dominant position will not be changed, but southeast asia will be the important supplement, jointly driving the development of the global electronics manufacturing industry.